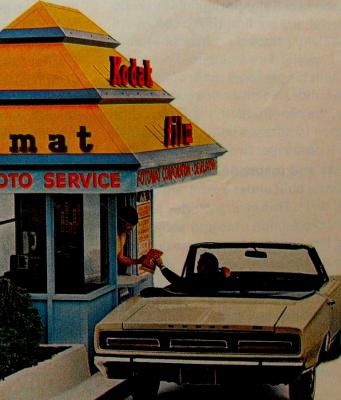

Artists mourn the digital death of an industry giant

The Eastman Kodak Co, one of photography’s leading pioneers has filed for bankruptcy protection from creditors after The Rochester, New York-based company, which traces its roots to 1880, listed assets of $5.1 billion and debt of $6.8 billion in Chapter 11 documents filed in U.S. Bankruptcy Court in Manhattan. The company that introduced the $1 Brownie Camera more than a century ago, moved from film to digital technology but has found it increasingly difficult to survive in an extremely competitive market.

The company’s credit deteriorated as revenue tumbled from traditional film, and the inventor of the Instamatic cameras was slow during the past decade to compete with Canon Inc. and Hewlett-Packard Co. in digital cameras and printers.Moody’s Investors Service on Jan. 5 cut ratings on about $1 billion of Kodak debt with a negative outlook, and cited “a heightened probability of a bankruptcy over the near-term” as liquidity deteriorates.

Kodak, which delivered the first commercially available camera in 1888, denied it had a bankruptcy plan, saying it was committed to meeting its obligations and is still looking for ways to “monetize” its patent portfolio worth a total of 2 billion dollars. Bloomberg reported that potential buyers for its patent portfolio were cautious about going ahead with a bid as they could risk having Kodak creditors sue them after a bankruptcy filing.Kodak has struggled with the move to digital cameras and has failed to be in profit since 2007. Kodak’s value plummeted to roughly $US 210 million down from a lofty height of $US31 billion in February 1997, as shown by regulatory filings. Kodak’s debt with credit default swaps (CDS) surged as investors priced in greater bankruptcy risk. Kodak had $957m in cash at the end of June and has said it expected to end the year with $1.6bn-$1.7bn.

Kodak shares plunged as much as 68% to 54 cents last autumn, before recovering slightly to close down 53.8% at 78 cents on the New York Stock Exchange. The company hired law firm, Jones Day known for bankruptcy cases, triggering speculation that the photography market leader could file for bankruptcy before the new year. This was not the case.

Fuji, Agfa and Ilford are now the only remaining market leaders and without them there will only be a handful of specialist film manufacturers left. I think the price of silver may also have been a factor in the demise of Kodak, no doubt they will now break up the divisions and become a Far East token brand like Polaroid.